As tax season approaches, it is important for individuals to be familiar with the different tax forms that they may encounter. One such form is the 1095-A form, which plays a crucial role in determining eligibility for premium tax credits under the Affordable Care Act. Let’s take a closer look at the 1095-A form and how it can impact your tax filing.

Understanding the 1095-A Form

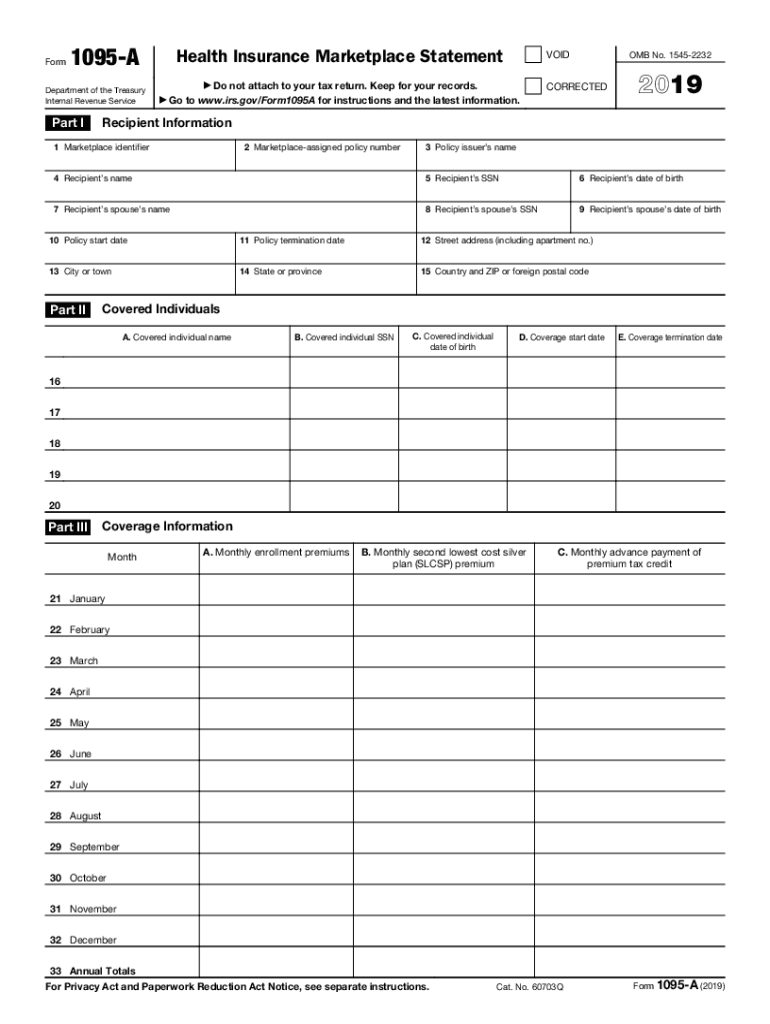

The 1095-A form, also known as the Health Insurance Marketplace Statement, is issued to individuals who purchased health insurance through the Marketplace. This form provides important information about the coverage obtained, the premium amount, and any advance premium tax credits received. It is essential for individuals to have this form in order to accurately complete their tax returns.

Image: Sample 1095-A Form

Image: Sample 1095-A Form

Using the 1095-A Form

Once you receive your 1095-A form, it is important to carefully review the information provided. This includes verifying the accuracy of your personal information, such as your name and Social Security number, as well as the covered individuals and coverage start and end dates. Any discrepancies should be addressed with the Health Insurance Marketplace as soon as possible.

The 1095-A form will also provide details about the premium payments made and the amount of any advance premium tax credits received. This information is necessary for calculating the premium tax credit on your tax return. It is important to note that if you received advance premium tax credits but did not report any changes to your income or family size throughout the year, you may be required to repay some or all of the credits when filing your tax return.

Image: Sample 1095-A Form

Image: Sample 1095-A Form

Filing Taxes with the 1095-A Form

When it comes time to file your tax return, you will need to include the information from your 1095-A form on IRS Form 8962. This form is used to reconcile the advance premium tax credits you received with the amount you are eligible for based on your income.

It is important to fill out Form 8962 accurately and attach it to your tax return to avoid any delays in processing. If you are unsure about how to complete this form, it may be beneficial to seek assistance from a tax professional or use tax preparation software.

Image: Sample 1095-A Form

Image: Sample 1095-A Form

Seeking Help

If you have any questions or need assistance regarding the 1095-A form, it is recommended to reach out to the Health Insurance Marketplace directly. They can provide guidance on any issues related to your coverage or the form itself.

Additionally, tax professionals are well-versed in handling tax forms like the 1095-A and can help ensure that you accurately complete your tax return. They can guide you through the process and help you understand any implications or potential repayment obligations associated with the form.

Image: Sample 1095-A Form

Image: Sample 1095-A Form