In our ever-changing world, it is important for individuals to stay informed about taxes and the necessary forms for filing. When it comes to taxes, knowledge is power, and understanding the specific tax forms relevant to your situation can help ensure that you are fulfilling your legal obligations while maximizing your deductions. Here are some notable tax forms and resources that can assist you in your tax journey:

- Downloadable Tax Forms 2020

Starting off, we have the Downloadable Tax Forms 2020. This comprehensive set of forms is essential for accurately reporting your income and claiming deductions for the tax year 2020. Whether you are an individual taxpayer or a business owner, these forms provide the structure needed to navigate through the complexities of the tax system.

Starting off, we have the Downloadable Tax Forms 2020. This comprehensive set of forms is essential for accurately reporting your income and claiming deductions for the tax year 2020. Whether you are an individual taxpayer or a business owner, these forms provide the structure needed to navigate through the complexities of the tax system.

- Use this Tax Form to Fill Out a 2017 Tax Form

If you haven’t filed your 2017 taxes yet, this unique tax form can help you complete the necessary documentation. Whether you experienced an extension or simply need to amend your previous return, this form walks you through the process in a clear and concise manner, ensuring accuracy and compliance.

If you haven’t filed your 2017 taxes yet, this unique tax form can help you complete the necessary documentation. Whether you experienced an extension or simply need to amend your previous return, this form walks you through the process in a clear and concise manner, ensuring accuracy and compliance.

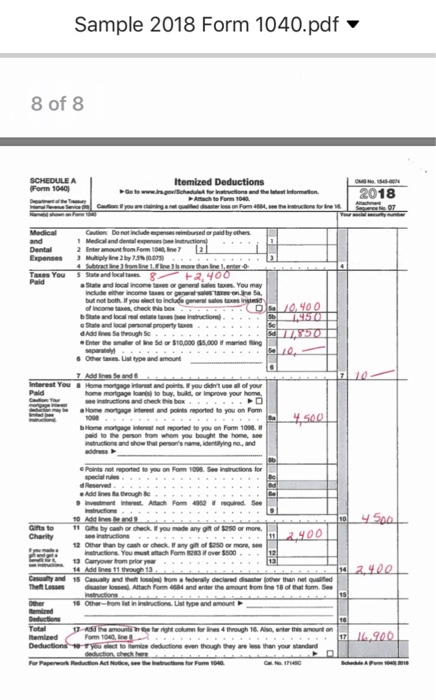

- What Tax Form Should I Use 2018 Tax Year

An important question that often arises during tax season is, “What tax form should I use?” This resource specifically addresses the 2018 tax year and provides guidance on selecting the appropriate tax form based on your income level and filing status. By using the correct form, you can ensure that your taxes are prepared accurately and efficiently, saving you time and potential issues.

An important question that often arises during tax season is, “What tax form should I use?” This resource specifically addresses the 2018 tax year and provides guidance on selecting the appropriate tax form based on your income level and filing status. By using the correct form, you can ensure that your taxes are prepared accurately and efficiently, saving you time and potential issues.

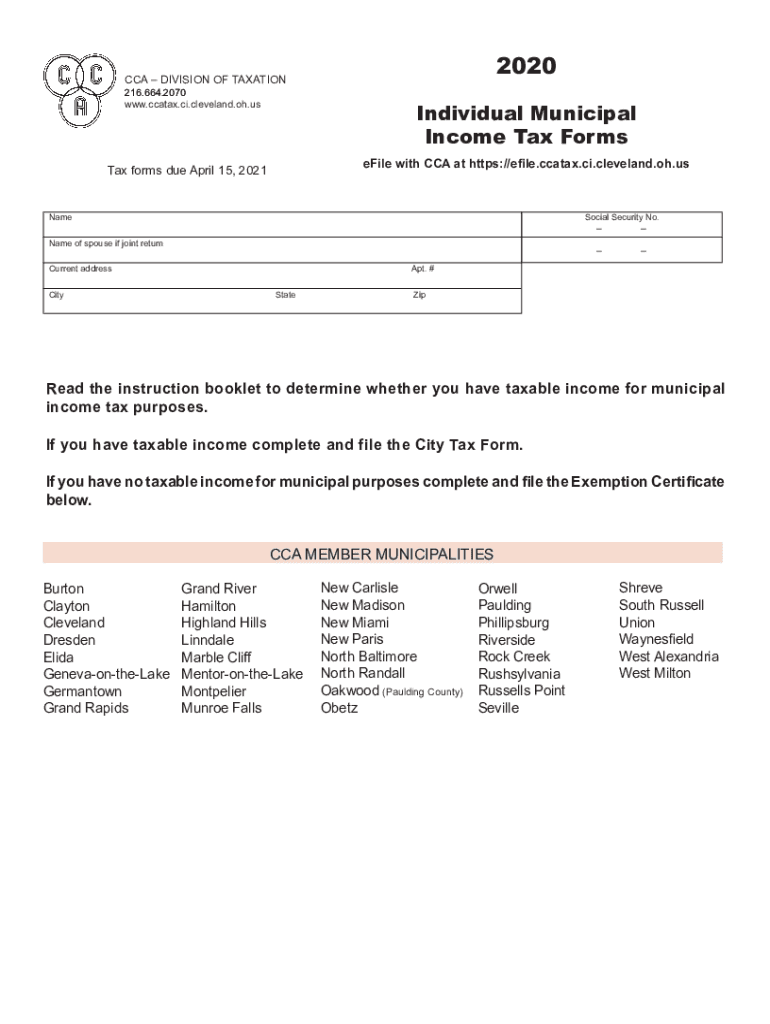

- Cca Form Tax

The Cca Form Tax is a useful tool for individuals who need to report their tax liability accurately. This printable PDF template allows you to fill out the necessary information and sign it digitally, streamlining the process and ensuring that your tax documentation is submitted on time.

The Cca Form Tax is a useful tool for individuals who need to report their tax liability accurately. This printable PDF template allows you to fill out the necessary information and sign it digitally, streamlining the process and ensuring that your tax documentation is submitted on time.

- The Federal Government Is Changing Its Tax Forms…Again

One constant in life is change, and that extends to tax forms as well. As highlighted in this article from PCMag, the federal government is once again making changes to its tax forms. Staying informed about these changes is crucial to ensure compliance and to prevent any errors in your tax filings. It is always advisable to check for the latest updates and versions of the tax forms to stay up to date with the current requirements.

One constant in life is change, and that extends to tax forms as well. As highlighted in this article from PCMag, the federal government is once again making changes to its tax forms. Staying informed about these changes is crucial to ensure compliance and to prevent any errors in your tax filings. It is always advisable to check for the latest updates and versions of the tax forms to stay up to date with the current requirements.

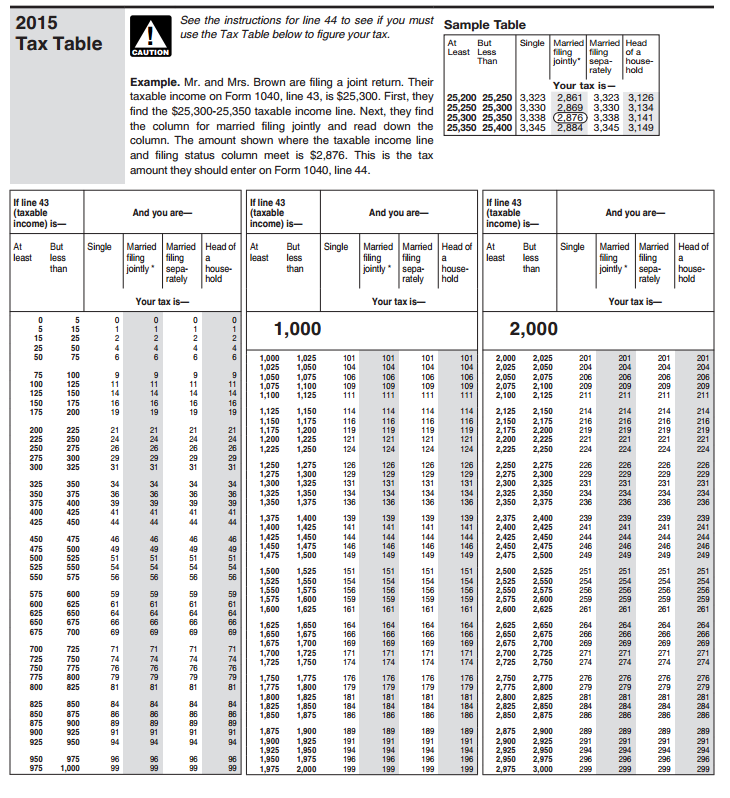

- IRS Federal Tax Withholding Table

The IRS Federal Tax Withholding Table is a valuable resource that helps employers and employees determine the correct amount of federal taxes to be withheld from wages. This table provides the necessary guidance, considering factors such as income level, filing status, and number of allowances claimed. Accurate payroll withholding ensures that the correct amount of taxes is withheld, preventing any surprises when it comes time to file your tax return.

The IRS Federal Tax Withholding Table is a valuable resource that helps employers and employees determine the correct amount of federal taxes to be withheld from wages. This table provides the necessary guidance, considering factors such as income level, filing status, and number of allowances claimed. Accurate payroll withholding ensures that the correct amount of taxes is withheld, preventing any surprises when it comes time to file your tax return.

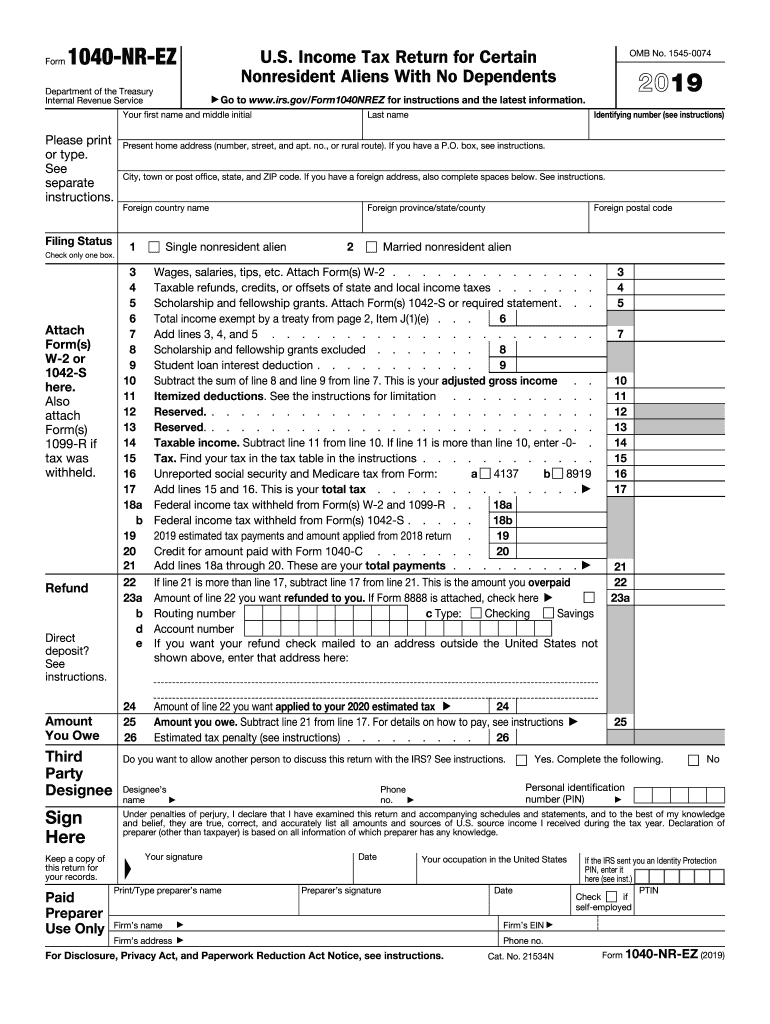

- 2019-2023 Form IRS 1040NR-EZ

If you are a non-U.S. resident alien who earned income within the United States, the 2019-2023 Form IRS 1040NR-EZ is specifically designed for you. This fillable and printable form simplifies the process of reporting your income, deductions, and credits, ensuring that you comply with U.S. tax laws while taking advantage of any eligible tax benefits applicable to your situation.

If you are a non-U.S. resident alien who earned income within the United States, the 2019-2023 Form IRS 1040NR-EZ is specifically designed for you. This fillable and printable form simplifies the process of reporting your income, deductions, and credits, ensuring that you comply with U.S. tax laws while taking advantage of any eligible tax benefits applicable to your situation.

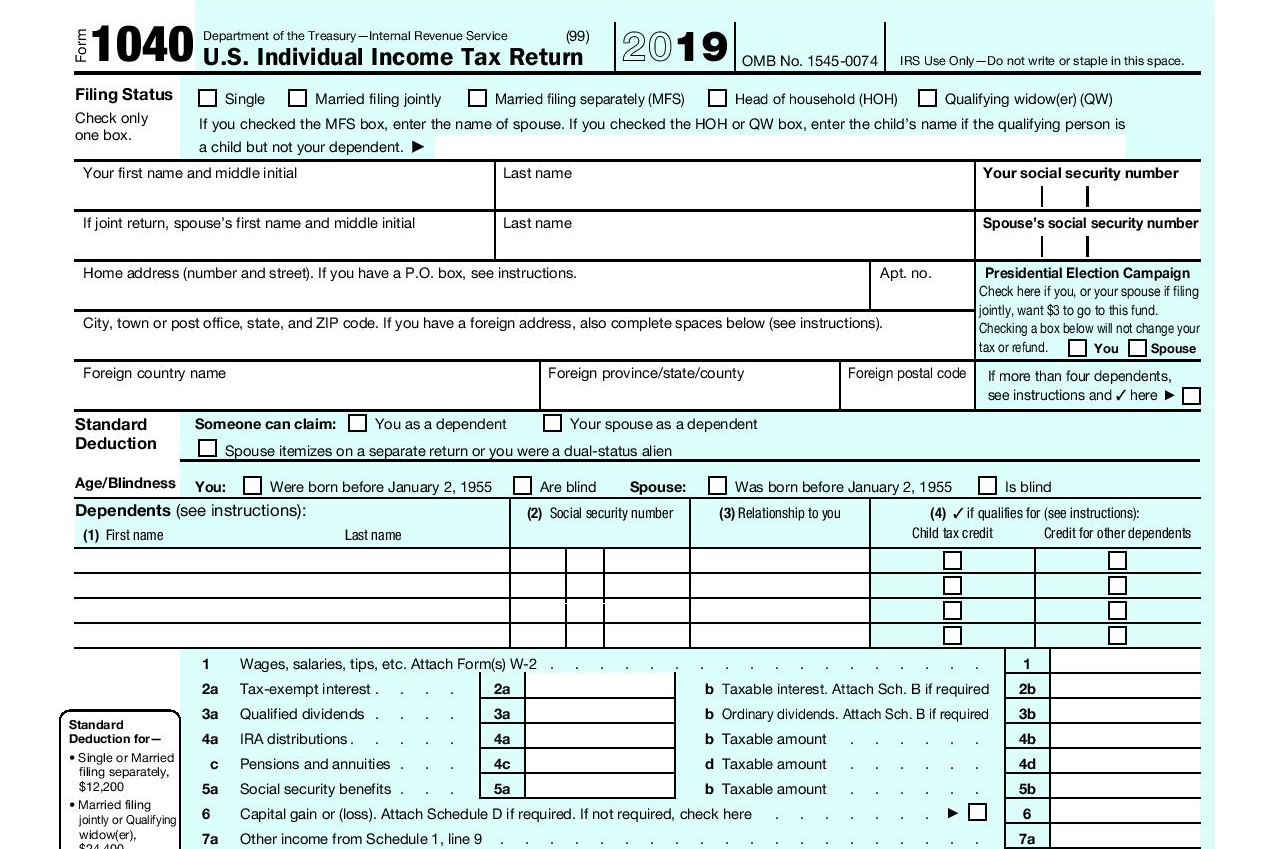

- Free Fillable Tax Form 1040

For individuals looking for a free and printable tax form, the Free Fillable Tax Form 1040 serves as an excellent option. This online resource allows you to complete your tax return electronically, eliminating the need for paper forms. It includes step-by-step instructions and built-in calculations to simplify the process and facilitate accurate reporting of your income and deductions.

For individuals looking for a free and printable tax form, the Free Fillable Tax Form 1040 serves as an excellent option. This online resource allows you to complete your tax return electronically, eliminating the need for paper forms. It includes step-by-step instructions and built-in calculations to simplify the process and facilitate accurate reporting of your income and deductions.

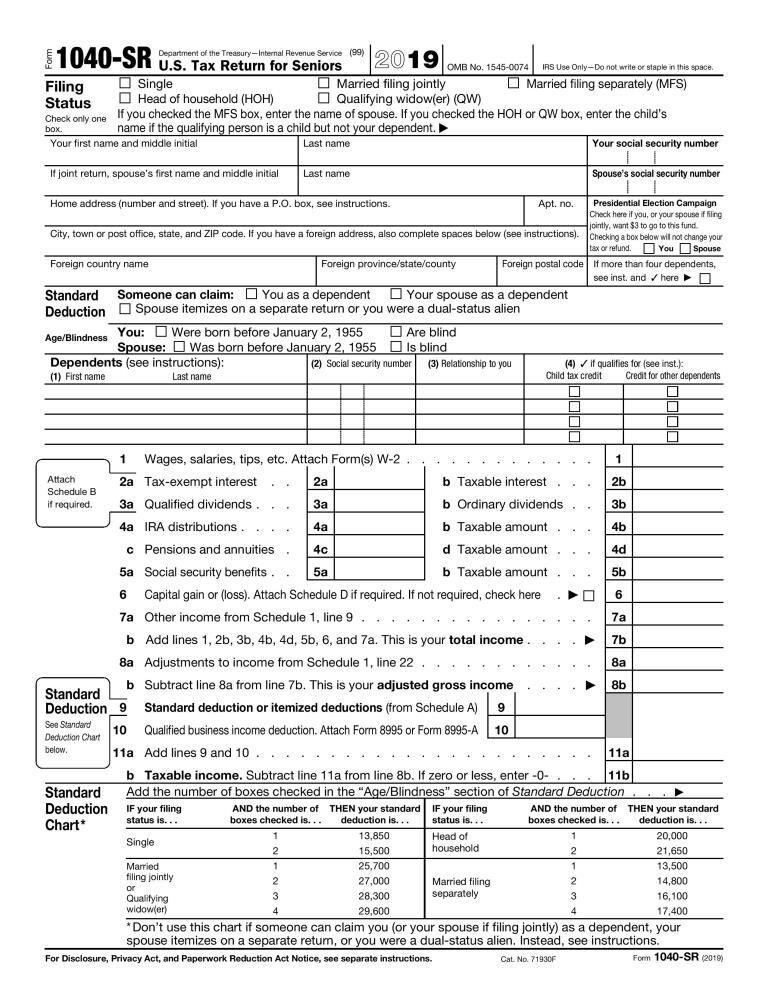

- FREE 2019 Printable Tax Forms

If you are filing your taxes for the year 2019, Income Tax Pro provides a collection of FREE printable tax forms. These forms cover various types of income, deductions, and credits, ensuring that you have all the necessary documents to complete your tax return accurately. By utilizing these resources, you can streamline your tax preparation process and minimize the stress associated with filing your taxes.

If you are filing your taxes for the year 2019, Income Tax Pro provides a collection of FREE printable tax forms. These forms cover various types of income, deductions, and credits, ensuring that you have all the necessary documents to complete your tax return accurately. By utilizing these resources, you can streamline your tax preparation process and minimize the stress associated with filing your taxes.

- Taxpayers Can Check The Status Of Their Refund

Once you have filed your taxes, it is natural to wonder when you will receive your refund. The IRS provides taxpayers with the ability to check the status of their refund online at IRS.gov or through the IRS2Go app. By entering specific information from your tax return, you can stay updated on the progress of your refund and gain peace of mind knowing when to expect it.

Once you have filed your taxes, it is natural to wonder when you will receive your refund. The IRS provides taxpayers with the ability to check the status of their refund online at IRS.gov or through the IRS2Go app. By entering specific information from your tax return, you can stay updated on the progress of your refund and gain peace of mind knowing when to expect it.

In conclusion, taxes are an integral part of our lives that require attention to detail and timely filing. Utilizing these diverse tax forms and resources can assist you in navigating through the complex world of taxes more efficiently. Remember to stay informed and always seek professional advice when necessary to ensure that you are compliant with the ever-changing tax laws.